Brady Doran, Mann Lake

Brady Doran, Mann Lake

For the past few years, U.S. honey prices have been retracting. Honey imported from a variety of sources has been depressing the prices of U.S. honey, but change is occurring. This season is slated to bring the highest honey price on record.

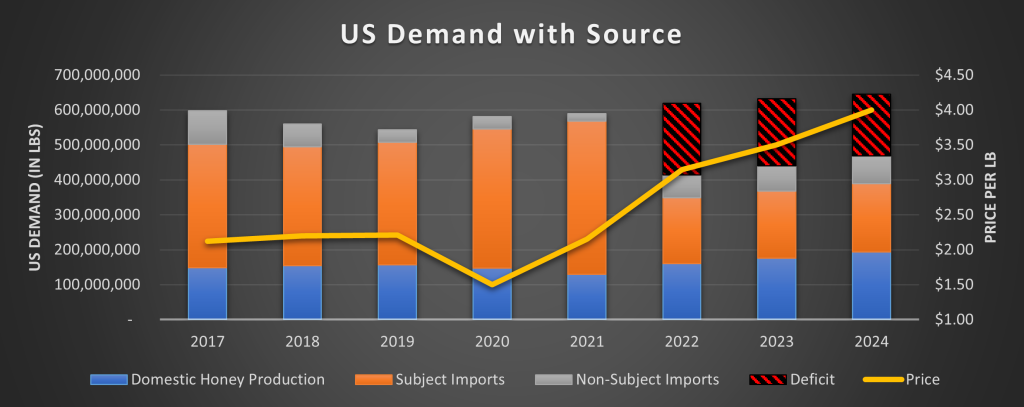

The U.S. demand for raw honey had increased from 524 million pounds to 534 million pounds between 2018 and 2020. This most likely stems from the perceived health benefits of consuming honey and concerns over artificial sweeteners.

During that same time, domestic raw honey production dropped from 154 million pounds to 147 million pounds, down from historical productions of over 230 million pounds.

Imports from Argentina, Brazil, India, Ukraine and Vietnam rose in U.S. market share from 60.8% to 68.4% between 2018 and 2020. Meanwhile, domestic U.S. production decreased in market share from 27.5% to 25.4%.

In the overall honey market, a majority of U.S. producers and importers reported lower market prices, more importing from these countries, more blending of U.S. honey with lower cost imported honey and higher rates of honey fraud (illegally labeled honey with no country of origin and honey diluted with fake honey and/or sugars).

Between 2018 and 2020, domestic prices for raw honey decreased by up to 30.5%, with the lightest color of honey being the most affected. This grade of honey accounts for more than half of all U.S. production. Prices for imports of raw honey from subject countries saw even greater decreases, up to 54%.

To combat this, in April of 2021, the American Honey Producers Association (AHPA) and the Sioux Honey Association (SHA) filed petitions with the Department of Commerce alleging that the domestic industry for raw honey production is being materially harmed by less than fair value (LTFV) imports of raw honey from Argentina, Brazil, India, Ukraine and Vietnam (subject countries). However, as a result of the current war in Ukraine, the petition for anti-dumping duties against them has been dropped. Honey production is still likely to be greatly disrupted and the U.S. cannot expect to import honey in any significant quantities from Ukraine.

An investigation like this is not new in the world of honey. In September of 2000, a petition was filed similar to this most recent filing, stating that honey from Argentina and China was being imported into the United States at LTFV. The DOC ended up ruling in favor of the U.S. and instituted anti-dumping measures against both countries. However, in 2012, the anti-dumping orders lapsed for Argentina, but remained in place for China and remain in place to this day.

In November of 2021, the DOC ruled in favor of the AHPA and SHA, stating that the subject countries were dumping honey into the U.S. market at LTFV and harming the domestic industry. As a result of this decision, preliminary duties were applied to all major exporters in all five subject countries:

Argentina – 8 to 49%

Brazil – 8 to 30%

Vietnam – 411 to 414%

India – 6 to 7%

We have already seen the effect these new tariffs materialize in the level of imports from these countries. Imports from all these countries are down dramatically, up to 94% in some cases.

Current trends imply a supply deficit of nearly 200 million pounds of honey for each of the next three years.

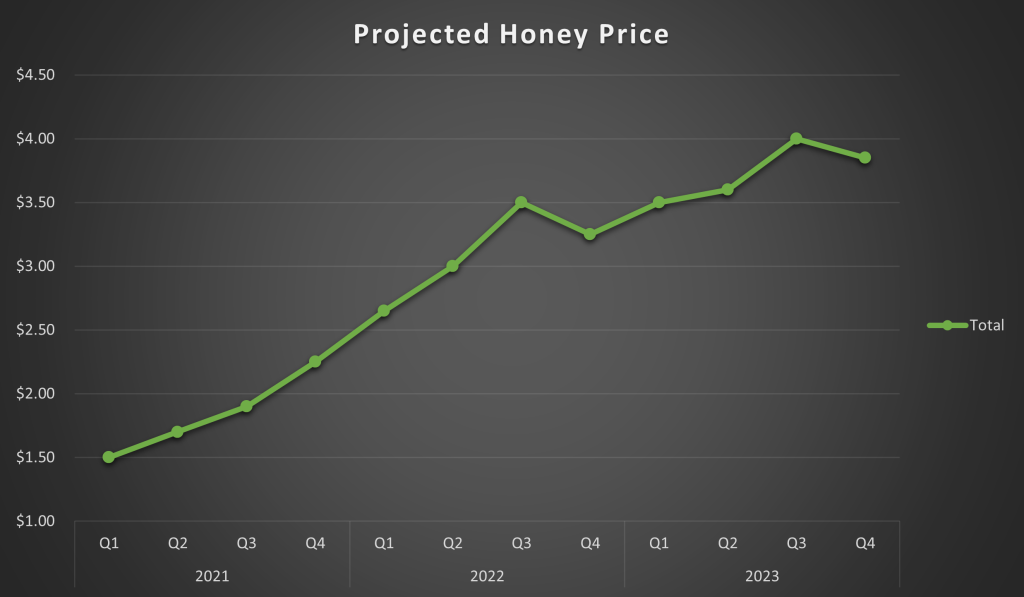

Applying simple economic principles would put a price floor of $3.00/lb for this upcoming season with $4.05/lb or greater within scope for regional and varietal honey.

To add another layer, consider the real cost of importing honey.

Indexed shipping rates from East Asia to the west coast of the United States and from northern Europe to the east coast of the United States have nearly tripled year over year.

This pushes the cost just to import honey north of $0.60 per pound for transportation only. Coupled with the increased duties from counties subject to the DOC ruling on anti-dumping, prices of imported honey will be pushed into the $3.00 per pound range and above.

With nearly 70% of U.S. imports being subject to tariffs and all imports being subject to increased transportation costs, $3 honey is the inevitable outcome in the short term with even higher prices on the way.